Banking automation is here. Are you ready?

A couple of weeks ago Goldman Sachs announced Deal Link, a platform that automates about half of the 127 steps of the IPO process. The launch of Deal Link is part of the firm’s broader mission to use technology across its workflows to enable junior bankers to take on more interesting, high-value work that will translate to a shorter path to “rainmaker” status.

Automation as a job perk is a pretty rare sentiment when it comes to technology in the workforce. Usually “automation” is shorthand for “job cuts”, such as speculation about Amazon’s plans to further automate its workforce. The retail giant pioneered home delivery by being laser-focused on product chain efficiency, so it’s no surprise that it will bring the same efficiency to Whole Foods. Just as it’s no surprise that for Ford, Carrier, and even McDonalds, automation will likely result in fewer jobs for humans.

Why isn’t this the case in banking? Why aren’t we worried about an army of IPO robots running roadshows? Or pitchbooks being replaced by an algorithmic matching system? Because in banking, the low-value work that can be automated is just one step in a multi-step workflow. For bankers, scrubbing data and creating content is just the beginning, what follows after is the actual work, the developing of advice and insights, the strategizing, the ideating—basically generating new and creative solutions to client problems—is what the bank actually monetizes. Pitchbooks by themselves don’t bring in money; it’s the ideas and the presenter behind them, so as automation and artificial intelligence become more prevalent, investment banks are poised to reap huge benefits—if they can get ahead of everyone else.

In a recent Harvard Business Review article, Ed Hess, a Professor of Business Administration and Batten Executive-in-Residence, says that many experts believe humans will remain critical in jobs that “require higher-order critical, creative, and innovative thinking.” Roles that require high emotional engagement won’t be replaced by AI and automation because “AI will be a far more formidable competitor than any humans. That will require us to take our cognitive and emotional skills to a much higher level” writes Hess.

Last year I wrote about how the future of banking will consist of human + tech teams, and Goldman Sachs’s Deal Link is a visible step toward this. While Deal Link automates about half of the 127 steps required for an IPO, that leaves about half that isn't automated. An IPO deal will still require a banker to perform ~60 different steps. This may reduce over time but it's more than likely that at least a third will remain the domains of humans. Automation will not be able to replace the chemistry meeting with the private company’s deal team, or talk to early investors and explain what’s special about the business, this will still have to be completed by humans as these are human-to-human tasks. However, as those 70+ other tasks can now be completed more easily and efficiently, Goldman’s bankers will have oodles more time to devote to these relationship building activities.

At Pellucid, we’re working toward a similar view of the future of banking. Instead of focusing on IPOs, we tackle the earlier part of the deal relationship—the creation of pitchbooks and other presentation materials. Data-driven content is essential to the pitching process and each pitchbook is basically the re-creation of the same wheel. By creating content automation solutions, we can make it easier for bankers to produce what they need, store and access it, and then leverage it for other clients.

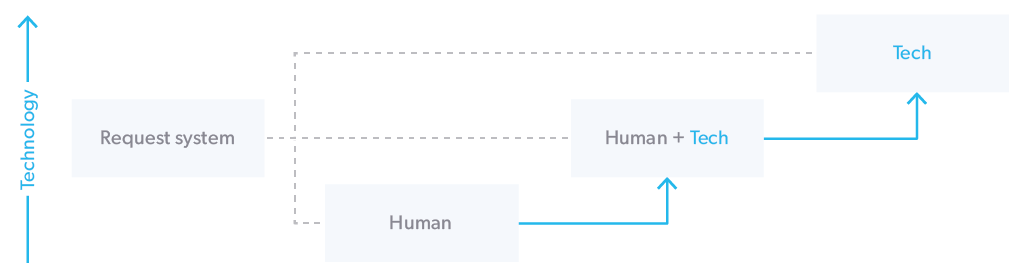

Fundamental to how we view the incorporation of automation and AI into the investment banking workflow is that it never stops. And I don’t just mean the output—although there will obviously be increased throughput—but the innovation. Once one workflow bottleneck has been automated, it’s on to the next. First developing a human-based solution, then human + tech, then pure tech, looking something like this:

This cycle will continue, automating more lower value work and pushing humans further and further up the value chain, initially to take on complex tasks, and then when investment banking technology reaches IBM Watson levels, to take the output of our smartest computers and turn it into compelling, sellable ideas.

We’re just beginning to understand what the future of banking could look like but the potential for a human and tech workforce is huge, and as of right now, so are the benefits for the first movers. Email me to see how Pellucid can bring next-generation technology to you at adrian.s.crockett@gmail.com.